Receivable Collection Period Formula

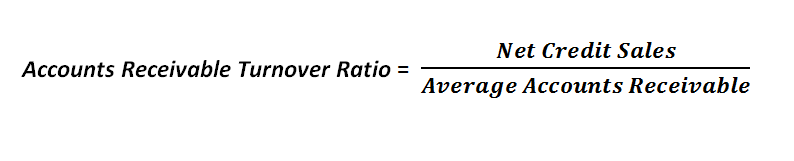

Net sales is calculated as sales on credit - sales returns - sales. Accounts Receivable AR Turnover Ratio Formula Calculation.

Average Collection Period Meaning Formula How To Calculate

The company must calculate its average balance of accounts receivable for the year and divide it by total net sales for the year.

. For instance other matrices like inventory days and receivable collection need to be calculated to assess the businesss cash position. Average accounts receivable Annual sales 365 days Average collection period. Date of invoice issued by Debtor Invoice Amount.

Average Collection Period. For example AR is forecasted to be 33mm in 2021 which was calculated by dividing 55 days by 365 days and. Generally the average collection period is calculated in days.

For example if Marias credit terms are 90 days then the average. The formula looks like the one below. To do so we will divide the carried-forward DSO assumption 55 days by 365 days and then multiply it by the revenue for each future period.

Average Collection Period Formula. This number is then multiplied by the number of days in the period of time. This means its accounts receivable is turning over approximately 9 times per year.

Accounts receivable turnover represents how frequently a business is able to collect on its credit sales within a period. Lets talk about how a company calculates its average collection period. The average collection period metric may also be called the days to sales ratio or the receivable days.

The measure is best examined on a trend line to see if there are any long-term changes. Whether a collection period of 6083 days is good or bad for Maria depends on the payment terms it offers to its credit customers. Compare accounts receivable collection period to the standard number of days customers are allowed before a payment is due.

If you have a lot of old accounts receivable especially after 60 or 90 days your collection processes may be weak. If you want to know more precise data divide the AR turnover ratio by 365 days. Average Collection Period Formula Average accounts receivable balance Average credit sales per day The first formula is mostly used for the calculation by investors and other professionals.

Now we can project AR for the forecast period. Receivable turnover in days 365 Receivable turnover ratio. Name of Debtors company or individual.

This metric overlooks non-financial factors factor-like customer relations creditworthiness trust and payment history etc. It measures how efficiently and quickly a company converts its account receivables into cash within a given accounting period. Amount of invoice in the desired currency.

In order to calculate. Calculate the AR turnover in days. Generally the average collection period is an important internal metric used in the overall.

For example suppose a company has an accounts receivable collection period of 40 days. The AR Turnover Ratio is calculated by dividing net sales by average account receivables. DSO can be calculated by dividing the total accounts receivable during a certain time frame by the total net credit sales.

Invoice number of the Debtors. Predefine the credit limit periodHere it is mentioned 30 days from. In the first formula to calculate Average collection period we need the Average Receivable Turnover and we can assume the Days in a year as 365.

Specifically it is calculated as. If you notice this trend you can adjust your collection practices such as sending invoices right away or working with a debt collection agency. This metric is connected.

Accounts Receivable Projection Using DSO. In other words this indicator measures the efficiency of the firms collaboration with clients and it shows how long on average the companys clients pay. The accounts receivable turnover ratio formula looks like this.

This way you can. On the face of it this seems beneficial to the company. Accounts receivable aging reports allow you to analyze how your collection processes are going.

Marias average collection period as computed above is 6083 days which means the company on average takes 6083 days to collect a receivable. Average collection period 365Accounts Receivable turnover ratio. The average payment period is the time the business takes to pay off its creditors.

The period of time used to measure DSO can be monthly quarterly or annually. Accounts Receivable Turnover Days Accounts Receivable Turnover Days Average Collection Period an activity ratio measuring how many days per year averagely needed by a company to collect its receivables. Alternative formula Average collection period Average accounts receivable per dayaverage credit sales per day read more and inventory processing period etc.

The average collection period is the approximate amount of time that it takes for a business to receive payments owed in terms of accounts receivable. In a business where sales are steady and the customer mix is unchanging the average collection period should be quite. Calculate accounts receivable turnover.

The result which will be a number likely greater than one will tell you how many times on average accounts receivable are collected upon during the period. The different important points related to the Average Payment period are as follows. Accounts Receivable Turnover Ratio Net Credit Sales Average Accounts Receivable.

The formula for the average collection period is. The data input section consists of the following subheading for data entry of Receivables. If the result is a low DSO it means that the business takes a few.

Accounts Receivable Collection Period Finansleksikon

Average Collection Period Meaning Formula How To Calculate

Accounts Receivable Collection Period Open Textbooks For Hong Kong

Comments

Post a Comment